What is a SPAC?

SPAC (a Special Purpose Acquisition Company) is a listed equity vehicle, allowing a team of managers with outstanding track record (the “Sponsor”), to collect capital through an IPO, for the purpose of a single acquisition of a private operating company (through a “Business Combination”, or “BC”)

What is a SPAC?

A SPAC scope and structure is defined in the Prospectus filed with the US Security Exchange Commission (SEC)

SPAC IPOs are typically listed at USD 10, including a warrant or part warrant and/or possibly a subscription right

The Capital collected is then 100% invested in 90 days US Treasuries held in an escrow account, segregated and not accessible

All costs of a SPAC until the BC (3-4% of capital collected) are borne by the Sponsor and not shared with investors

A SPAC objective scope is to find a good private company to be acquired through a reverse merger

The Management has up to 24 months to conclude the BC; alternatively it will return capital

Until the BC, the SPAC is a listed equity position (on the NYSE or on the Nasdaq)

Every SPAC investor always retains the option, by the very nature of the SPAC, to ask for capital redemption at the General Shareholders Meeting (recovering capital plus accrued interests)

The Evolution of the US SPAC Market

ACTIVE UNIVERSE OF US LISTED SPACs (as of 5 of Nov, 2020) – 227 SPACs - TOTAL MARKET CAP: USD 73 bn

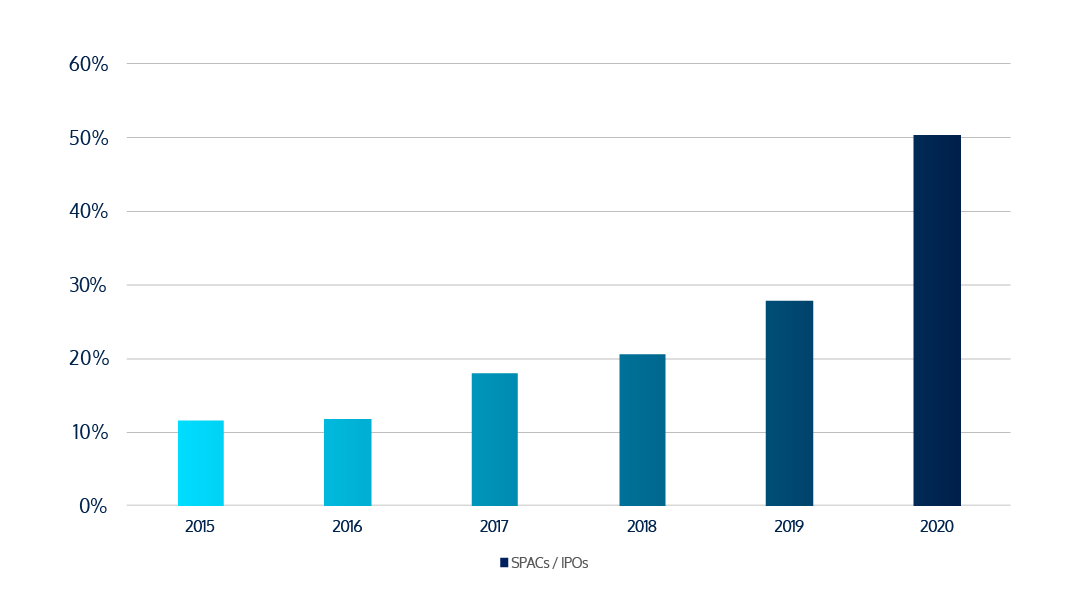

NUMERICAL COMPARISON: SPAC vs TRADITIONAL IPOs

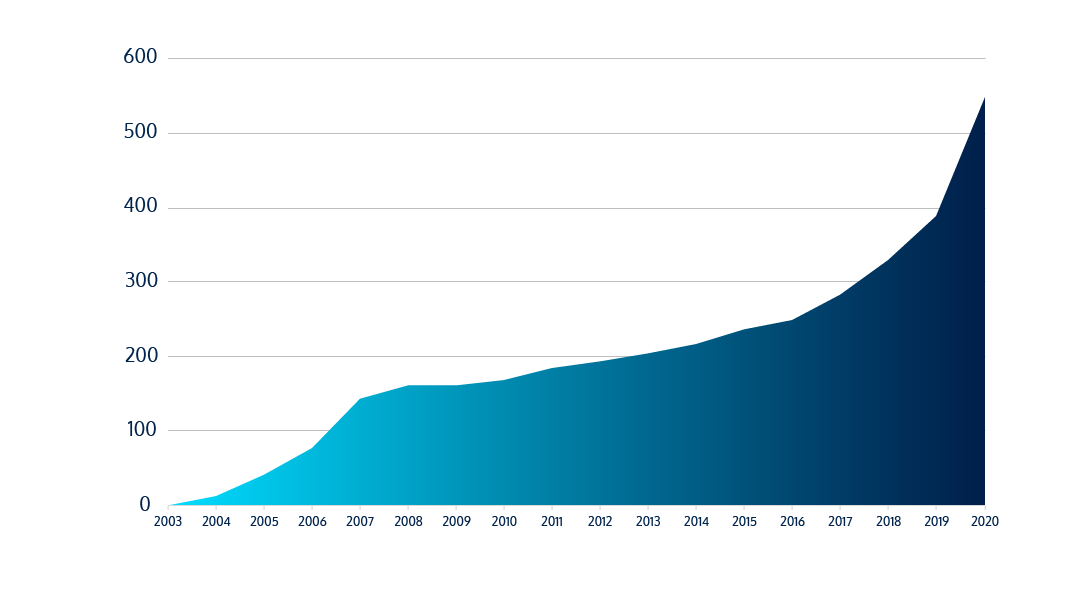

US SPAC IPOs: THE TREND

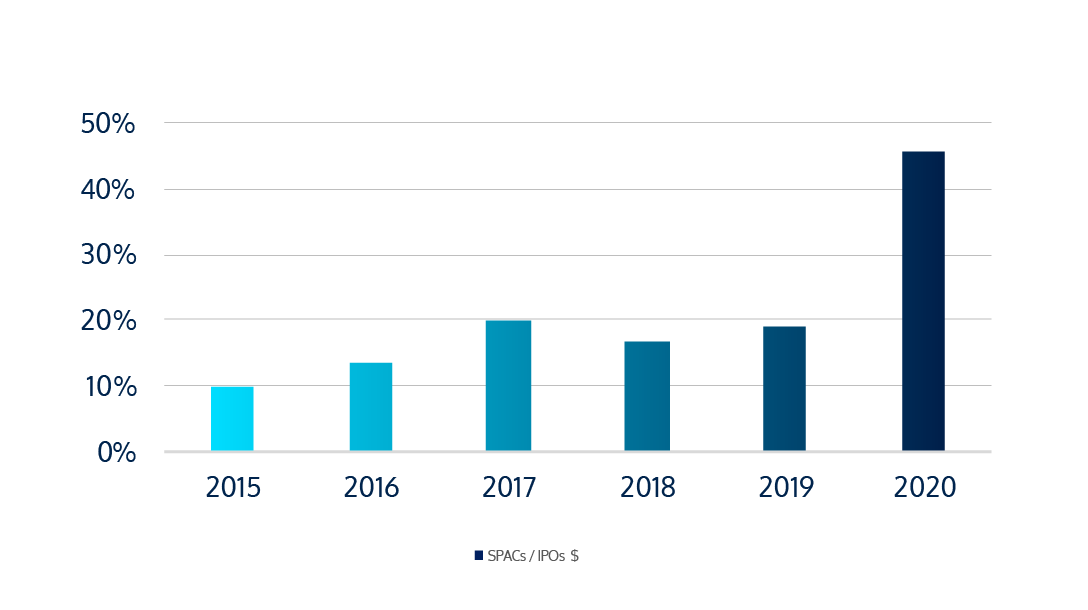

CAPITAL COLLECTED: SPAC vs TRADITIONAL IPOs

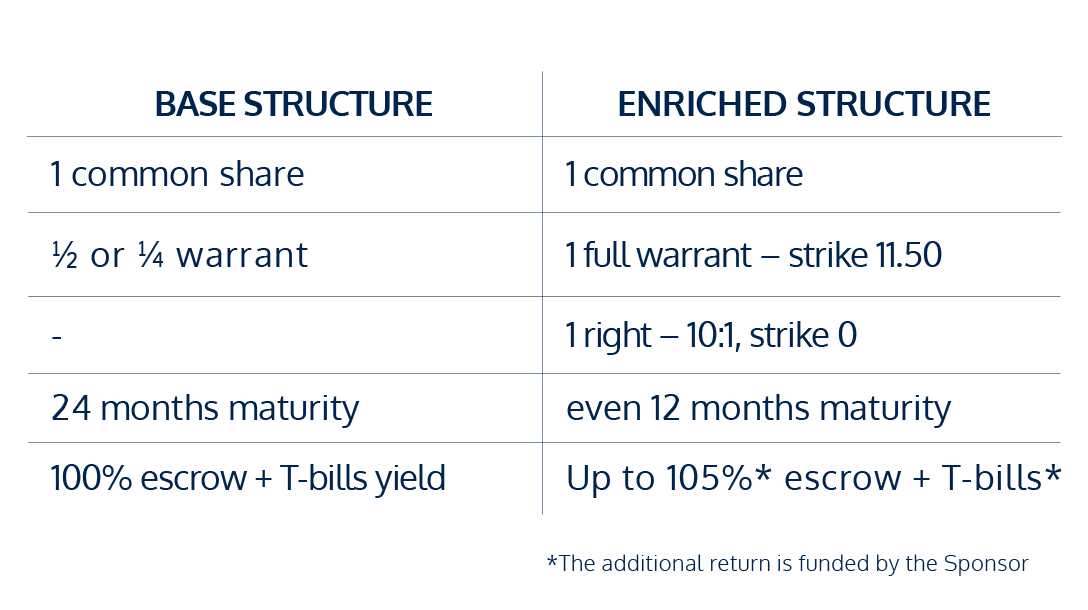

THE INTENSIFIED COMPETITION AMONG SPAC SPONSORS

RESULTED INTO MORE APPEALING SPAC STRUCTURES

SPACs typical behaviors during their life

SPACs typically exhibit 2 different behaviors that are aligned with the milestones of their life cycle, before the BC

1. During the phase between the IPO and the Announcement, the SPAC, traded on the listed markets, typically displays a very stable trading pattern due to its nature: being a pool of capital invested into US T-Bills with no operating activities

2. During the phase between the Announcement and the Business Combination, the market reacts the potential acquisition offering interesting divestment Opportunities

1. During the phase between the IPO and the Announcement, the SPAC, traded on the listed markets, typically displays a very stable trading pattern due to its nature: being a pool of capital invested into US T-Bills with no operating activities

2. During the phase between the Announcement and the Business Combination, the market reacts the potential acquisition offering interesting divestment Opportunities